System Design /

Cross-Functional Alignment / Leadership & Influence

Superbank + OVO + Grab Integration

Grab’s digital bank (Superbank) aimed to acquire its first 1 million users by year-end. To get there, they needed a fast, compliant integration inside Grab’s e-wallet (OVO). Design and ship an MVP in ~3 months for regulator approval.

I led design alignment across Grab, OVO, and Superbank by driving the flows, the rules, and the decisions required to ship something compliant, feasible, and scalable under extreme time pressure.

My Role

Led design across OVO, Grab, and Superbank

Drove end-to-end design across OVO, Grab, and Superbank

Aligned PMs, compliance, engineering, design and many other teams

Made the scope, branding, and decisions needed to unblock teams

Balanced short-term MVP with principles for future phases

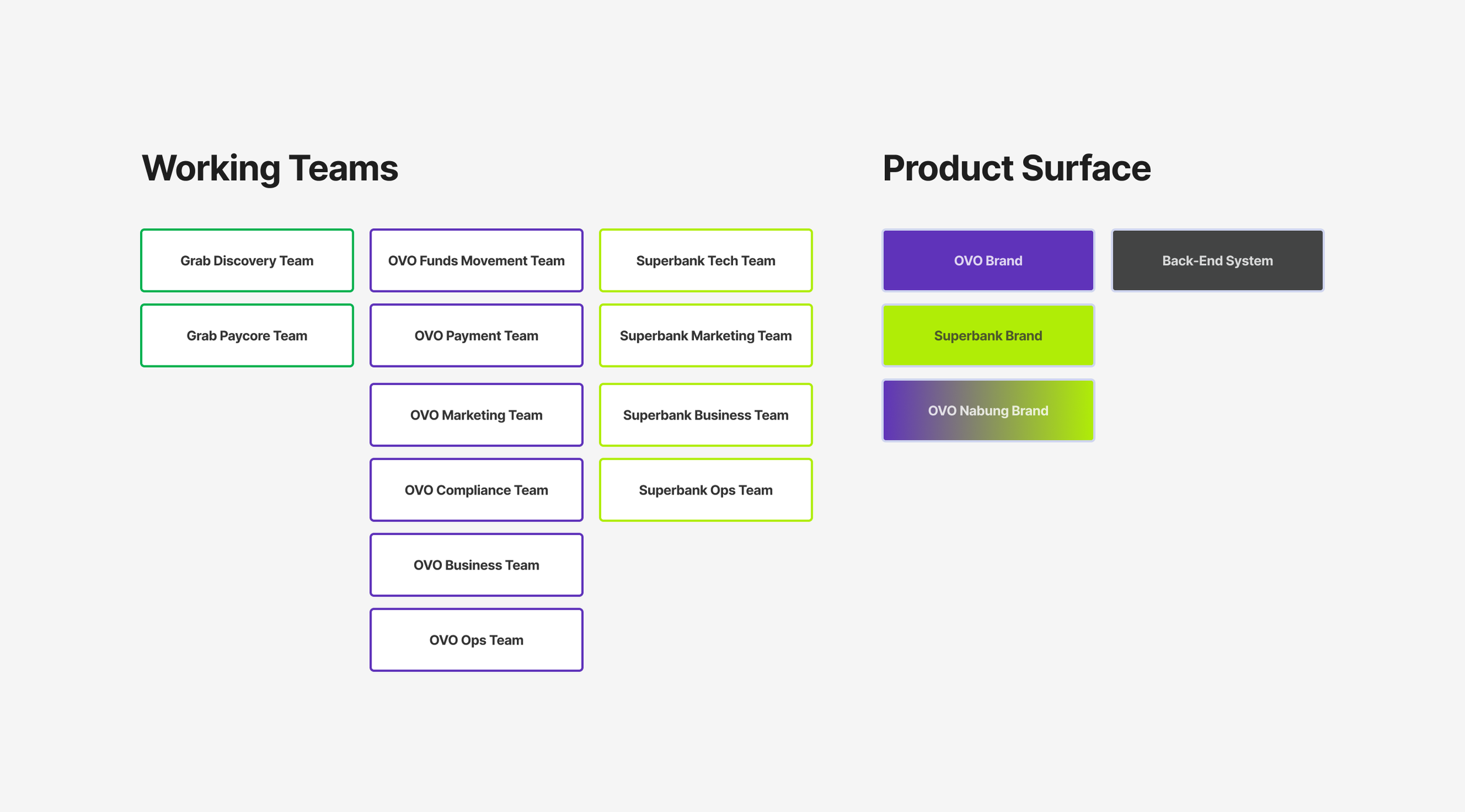

Working Teams and Product Surface

The Situation

When work started, nothing was defined

No name

No brand identity

No logo/icon

No finalized product scope

No clarity on cross-app upgrade rules

No alignment on what was mandatory for regulator approval

Different companies, different processes, different working styles

Despite that, we had to deliver design fast so engineering could develop, while keeping space for the late-arriving strategic decisions.

Challenges

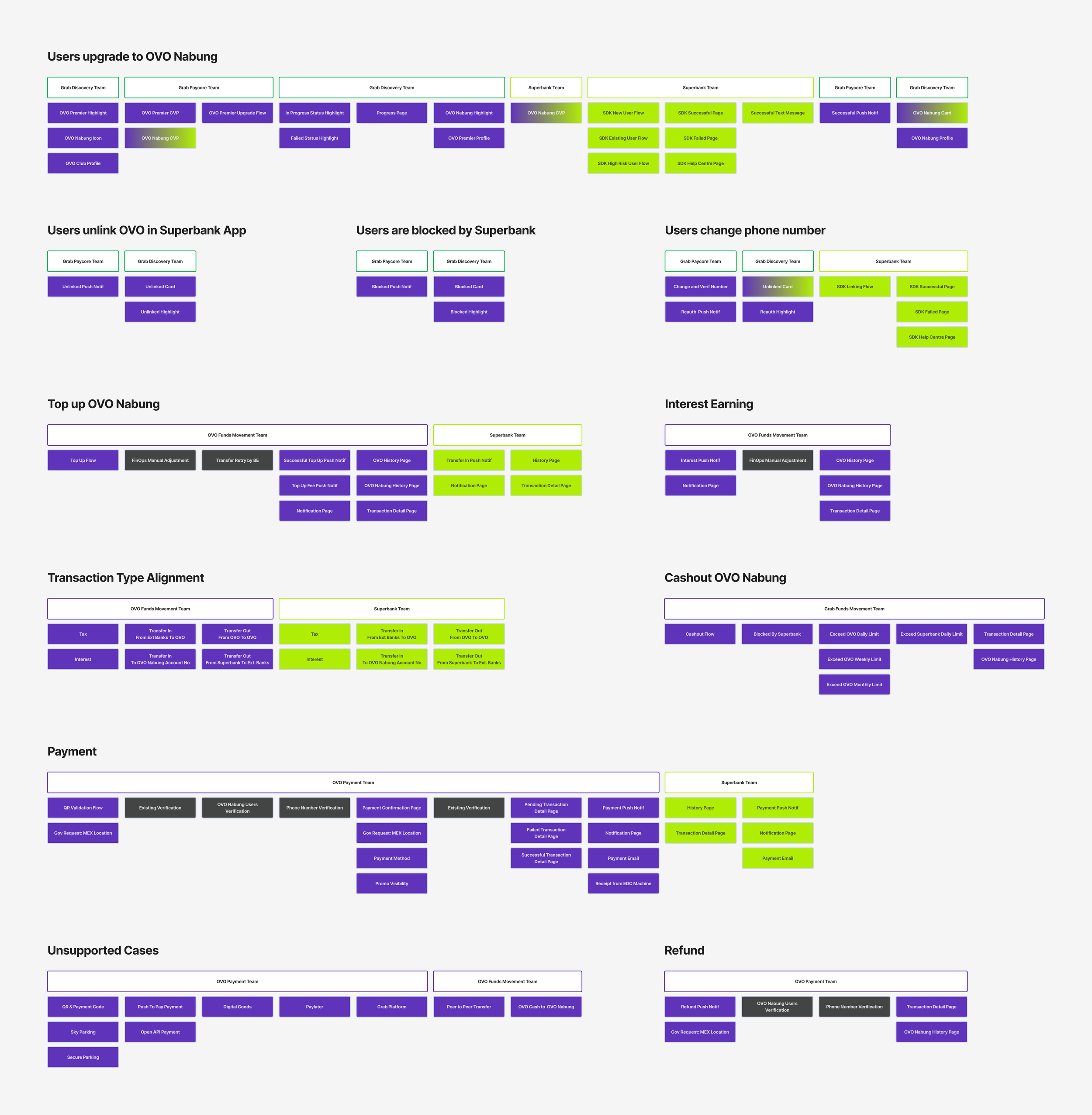

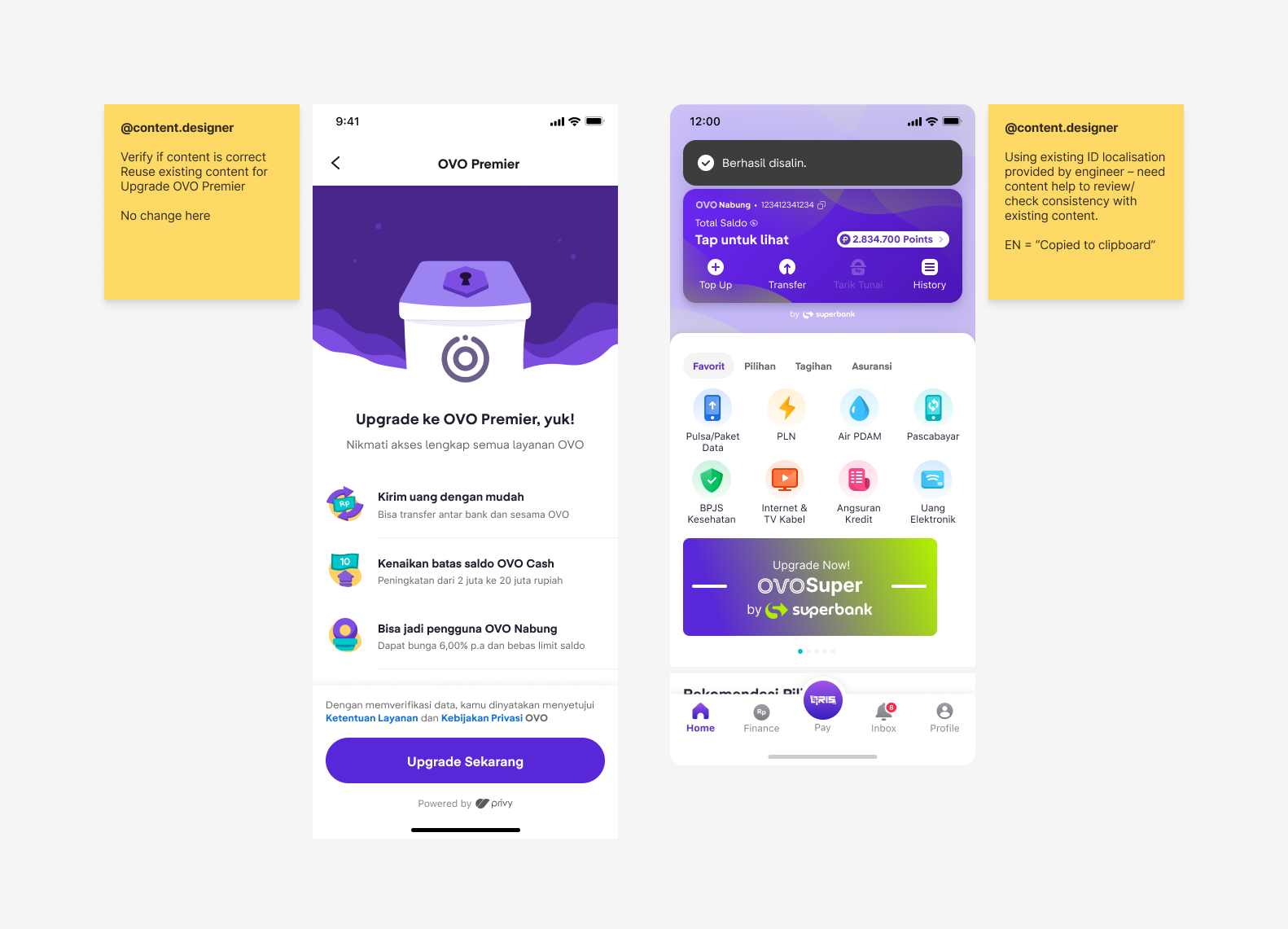

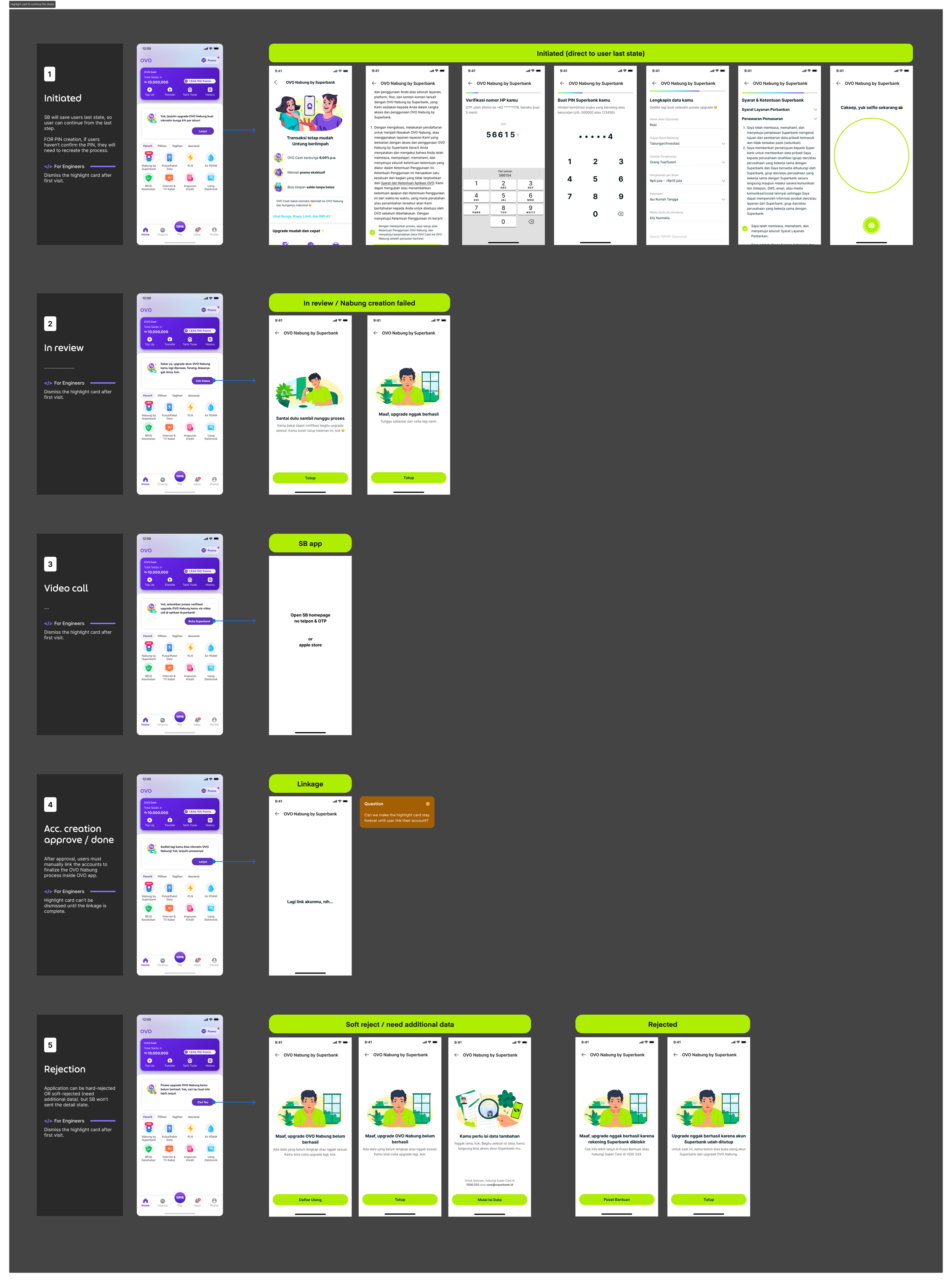

System snapshot for regulator approval with product surface and team indicator

Three companies, three priorities

OVO, Superbank, and Grab operated differently. Each had its own process and expectations.

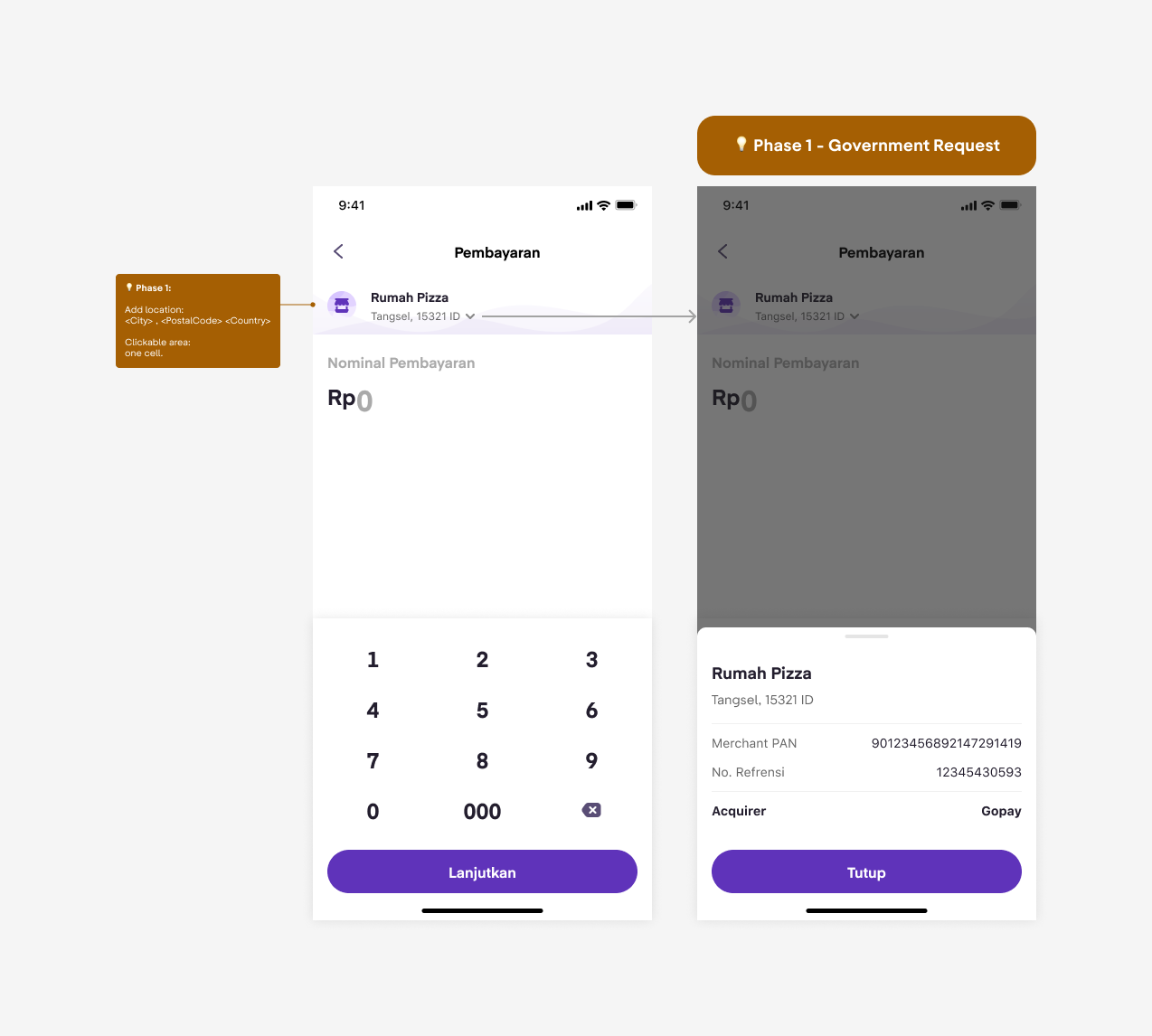

Regulator-driven constraints

Banking requirements affected:

Wording

Verification steps

Required screens

Branding hierarchy

One of government requests

Brand and Design System mismatch

OVO Nabung sat at the intersection of two existing design systems and brands:

Superbank delivered SDK with their own branding and system

OVO required strict adherence to Grab design system and OVO brand

Users needed to understand when they were interacting with OVO, Superbank, or the joint product

At the same time, the project ran under extremely tight timelines, which meant the solution had to be efficient, reusable, and low-friction.

Introducing a new product identity (OVO Nabung) without breaking either system and without over-branding neutral flows became a key challenge.

OVO’s style and colours vs Superbank’s style and colours

Non-Indonesian designers working with Indonesian copy

I needed to define a way of working between our product designers and content designers while being more meticulous with the content in design review sessions.

Product designers x content designers

Long-term vs Hard Deadline MVP

We needed something shippable in 3 months (missing the regulator window would force a significant delay) without creating long-term debt especially around transaction history, which would break if not designed correctly upfront.

What I Delivered

Forced early alignment on identity & branding

Leadership was stuck debating names.

I pushed decisions forward by grounding them in:

Clarity on how brand length matters to users, not just for business/marketing for examples “Tokopedia → Tokped”, “Bukalapak → BL”, etc.

Risk of blocking design and engineering timelines

Result:

We established a working name, brand color, and identity rules early enough to avoid delays.

Icons & illustrations based on the respective brandings

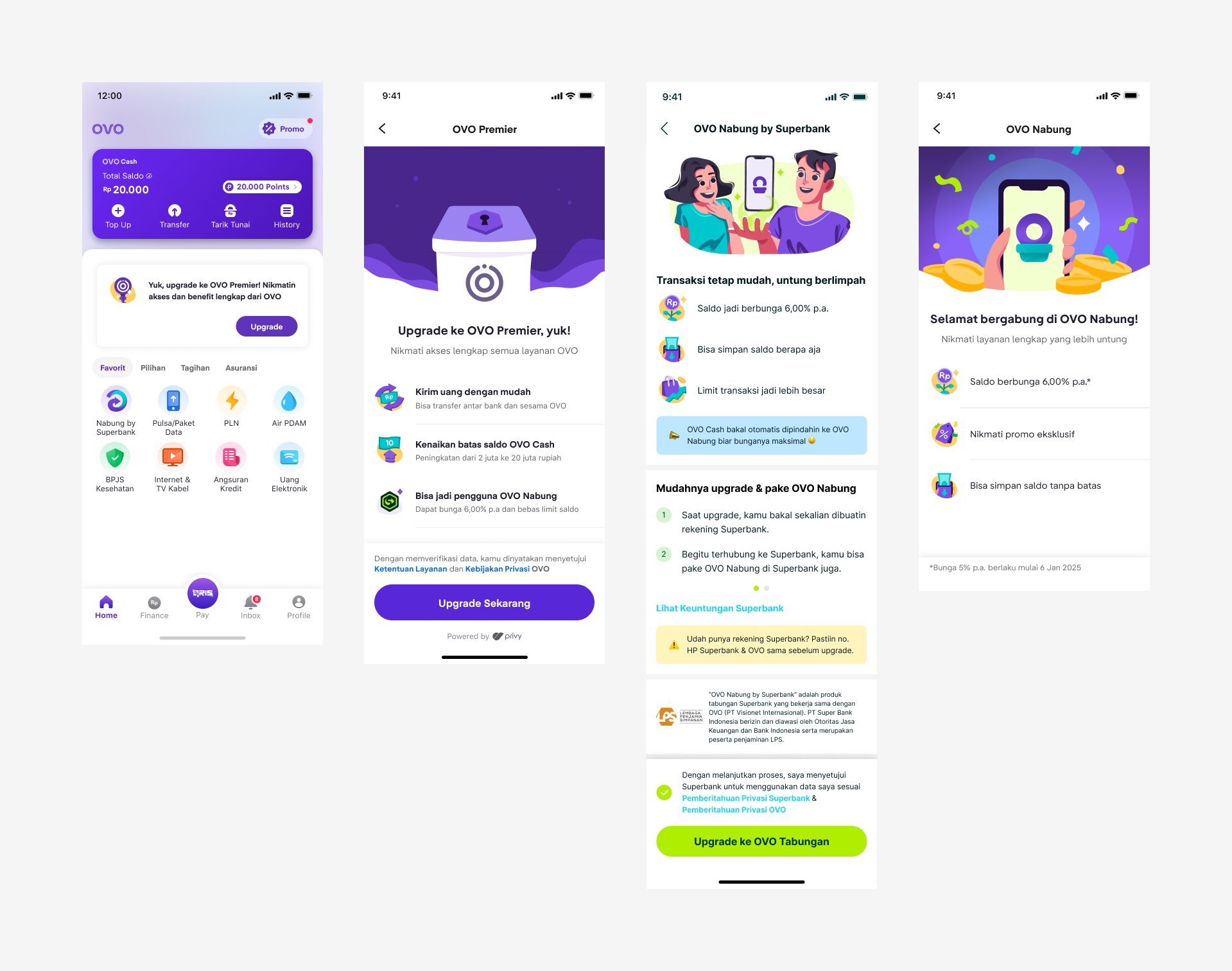

Defined the end-to-end upgrade journey

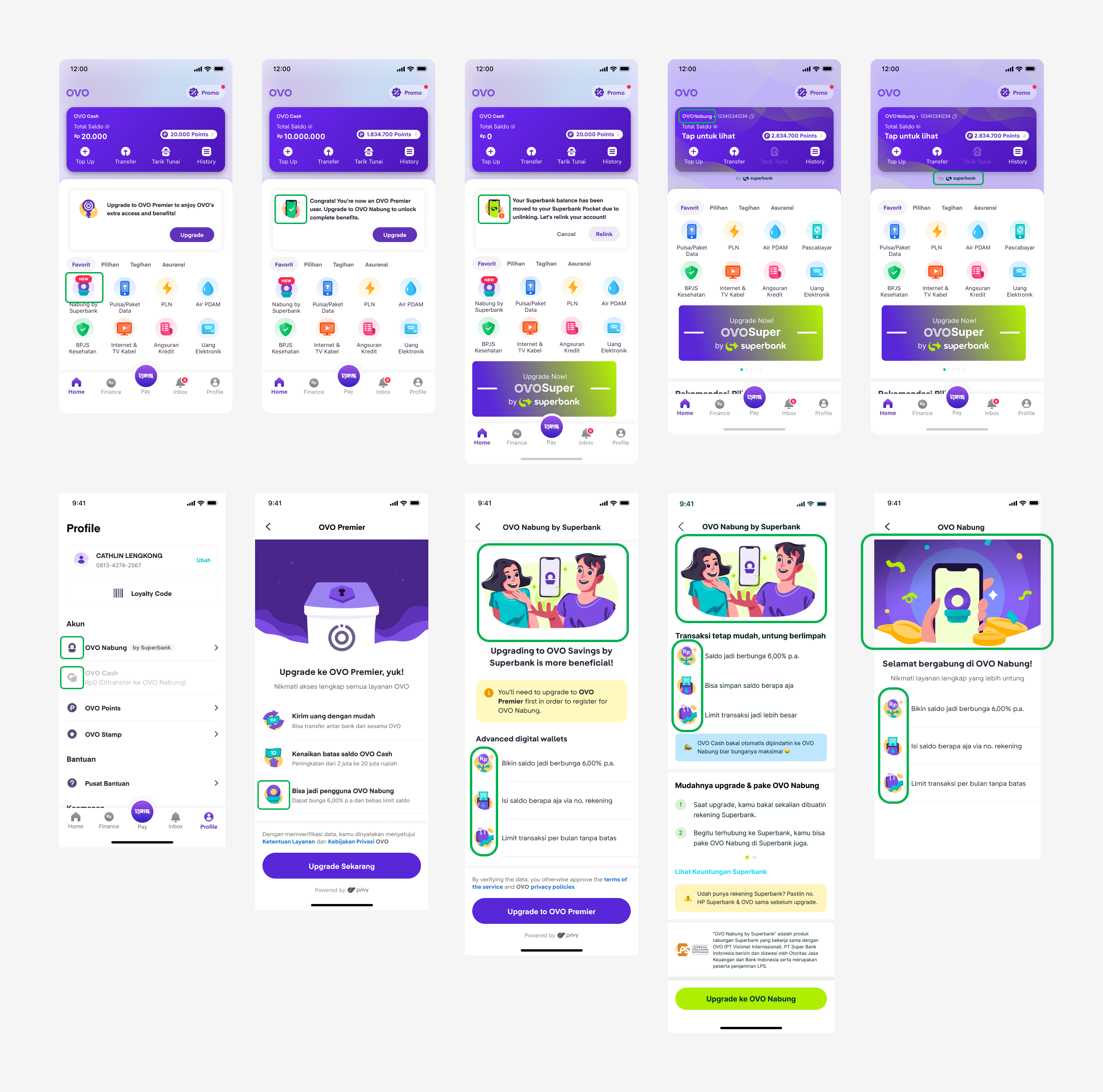

I clarified and aligned the full sequence: OVO Club → OVO Premier → OVO Nabung

From OVO Club users to OVO Nabung Users

This required:

ensuring flows remained consistent

ensuring language and edge cases were regulator-ready

defining when the user sees OVO vs Superbank branding, or even the combination of both branding (OVO Nabung)

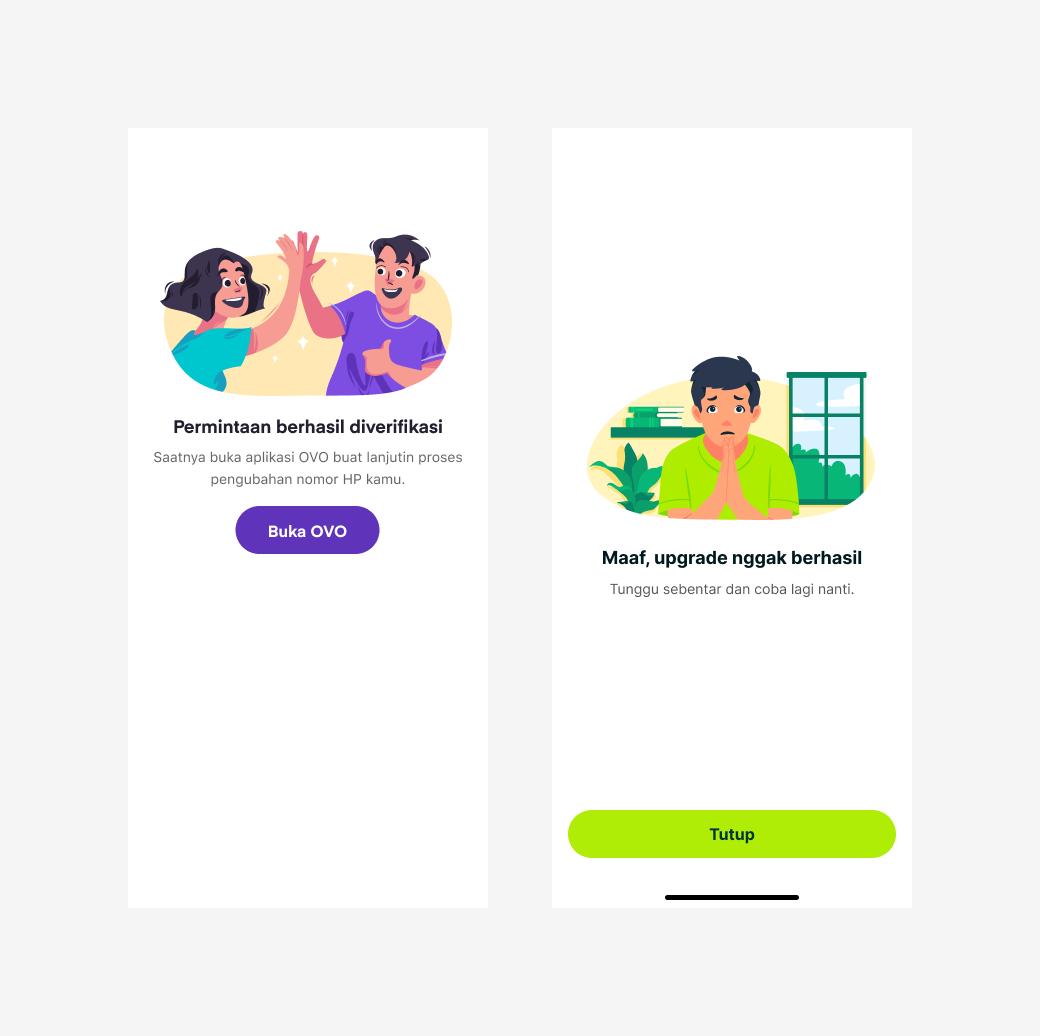

designing the fallback states for blocked/failed as well as taking into consideration the unsupported cases

This became the foundation used by teams across the companies.

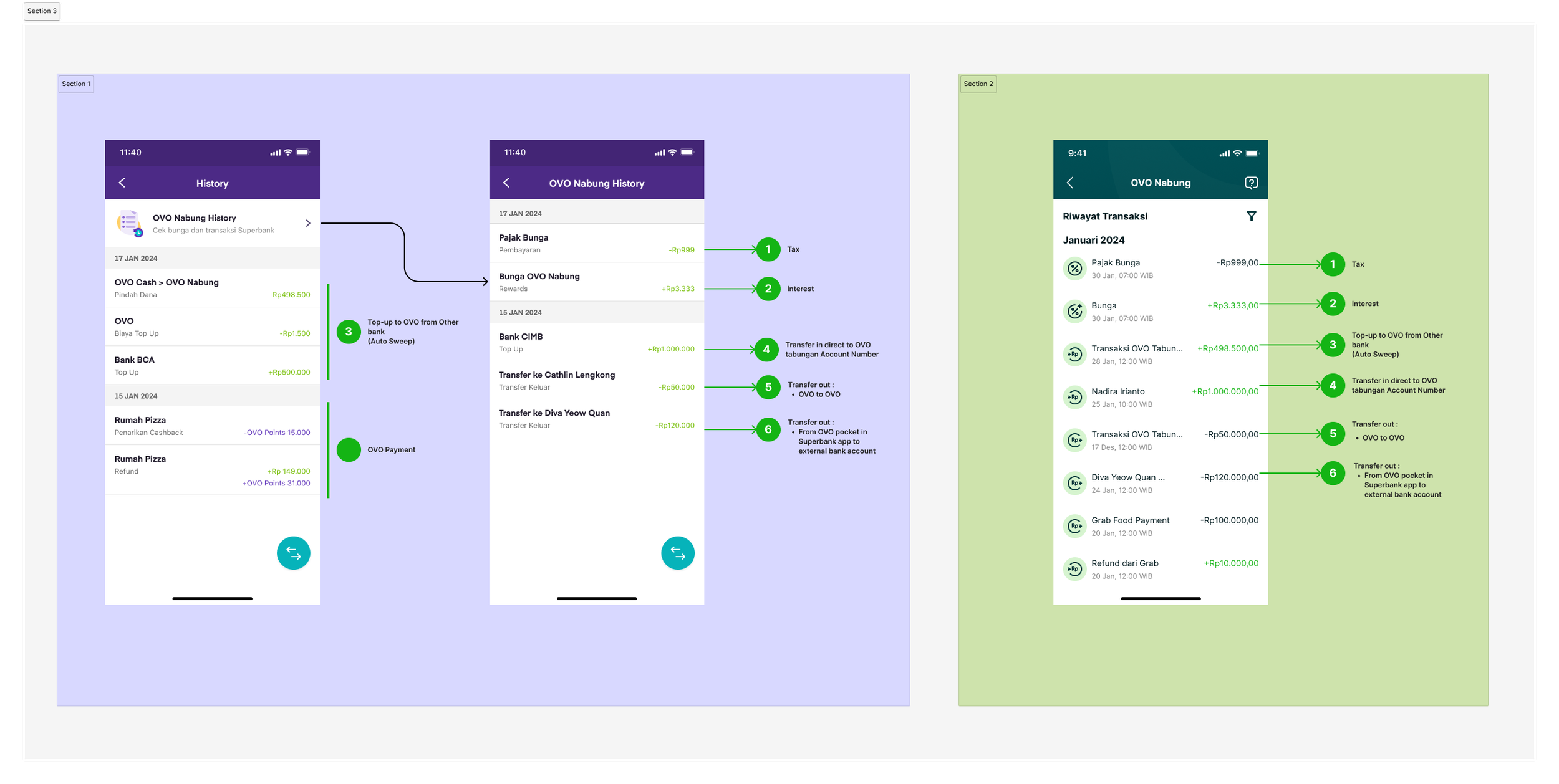

Solved the multi-app transaction history problem

To let teams build OVO Nabung transactions into OVO and Grab later, we needed a unified, principle-driven model.

Before this, every team had a different interpretation about which transactions should appear in which app.

If not aligned early, teams would redesign and rebuild multiple times.

I created the transaction history principles that were validated quickly with past research, competitor analysis, and engineering constraint.

If a source-of-funds feels external to users, only show transactions that have been done in the app.

If it feels internal, show all the transactions.

Every transaction must appear on at least one app the user has.

This prevented long-term fragmentation and made v1 shippable.

At the same time, we need to integrate OVO Nabung History into the current history page of OVO with as little effort as possible while aligning with Superbank Team of the possible transaction types for both app.

OVO History vs OVO Nabung History

Cross-team alignment across OVO, Grab, and Superbank

I drove the alignment across:

5 design teams

(OVO Payments, Grab Paycore, Grab Onboarding, OVO Funds Movement, Superbank team)Multiple PMs

Content designers from OVO and Superbank

Illustrators from OVO and Superbank

Grab design system team

OVO compliance team

Engineering teams

Because timelines were so tight, my role wasn’t just leading design. It was orchestrating decisions, unblocking teams, and committing to paths quickly to prevent delays.

Shipped a regulator-ready MVP on time

The final scope included:

OVO Club → Premier → OVO Nabung upgrade

Existing OVO Nabung account linking and unlinking

Change phone number flow

Block users states

Push Notifications and Emails

Top-up flow

Cash-out flow

Payment and refund flow including promo for OVO Nabung

Unsupported cases since not every feature was available in v1

Help Centre

Brand-consistent UI across OVO + Superbank

Scalable transaction history model

All design was completed ahead of engineering schedule and successfully used in the submission to the regulator.

The screens and flows for regulator-ready MVP

Outcome

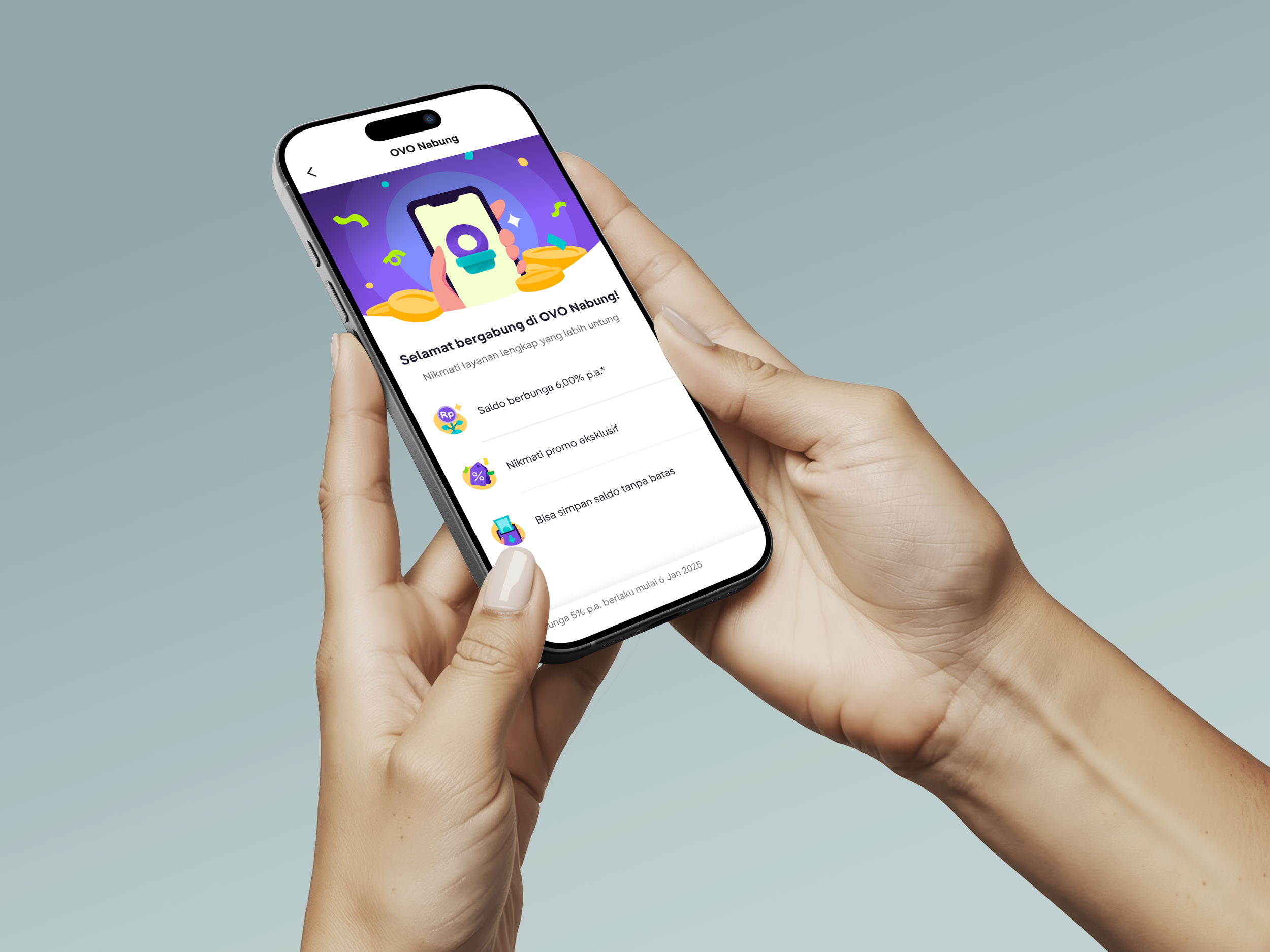

OVO Nabung launch event, enabled by the successful delivery of this work

Regulator-ready launch delivered on time, establishing the foundation for the first 1M users

Delivered all regulator-required design artifacts on time, unblocking submission

Unblocked engineering across two companies through clear system rules and ownership

Aligned three organisations (OVO, Grab, Superbank) on naming, identity, and core flows

Established the transaction history model and core project foundations, creating clarity that allowed teams to scale the product beyond the first phase

Shipped the end-to-end flow with minimal rework, despite high ambiguity and tight timelines

Why it Matters

This project wasn’t about visuals. It was about judgment under pressure.

Operating under extreme time and regulatory constraints

Navigating multi-organisation politics and ownership boundaries

Unblocking teams quickly to prevent delivery stalls

Making high-judgment calls with incomplete information

Balancing MVP delivery with long-term system coherence

Shipping a regulator-ready product in 3 months

UI & Interaction

Growth & Conversion

Product Discovery & Insight

Revamping Sign-Up Process

Redesigned the onboarding flow end-to-end to remove friction and clarify requirements, increasing registration success by 2.8×.

Move Without Authority

Moved complex initiatives forward without formal authority by challenging assumptions, reframing constraints, and restructuring incentives across product and organizational systems.

UI & Interaction

Product Discovery & Insight

Growth & Conversion

Adapting More Variants

Scaled the product detail experience to support more variants using a reusable pattern and component updates that preserved clarity and increased add-to-cart performance.